Travel Credit Cards are primarily introduced and designed to provide rewards to travelers to reimburse travel expenses and help them to save money while exploring new destinations. Best Travel credit cards come with various perks, such as earning airline miles, hotel points, or flexible travel rewards that can be redeemed for flights, hotel accommodations, car rental services, and many more.

World’s best travel credit cards offer attractive sign-up bonuses, where you can earn a large number of travel rewards points or miles when you meet a basic requirement within a specified time frame. These bonuses will be worth $100 in travel value. TSA Precheck or Global Entry application fees are special cards that provide lounge access, travel insurance, and other benefits like statement credits to a ambitious backpacker.

Related Search: Best Travel Apps.

Top 10 of the Best Travel Credit Cards for Various Preferences and Travel Needs

1. Chase Sapphire Preferred

Chase Sapphire’s Preferred is one of the vital travel cards for providing flexible travel rewards and attract travel perks with its good sign-up bonus. You will get an option like trip cancellation/interruption insurance, car rental insurance, and no foreign transaction fees under this Credit card.

Credit card allows you to get a point on everyday purchases as early as possible. Bonus is provided to travelers for those who are facing costs in their first purchase. Its famous features of this credit card are;

- Travel Insurance/ Travel accident insurance

- Free subscription to doordash

- No foreign transaction fees

- Travel and emergency assistance

- Rental car insurance

- Combine points with freedom cost

- Transfer points to the Travel partner

- 10% annual earning bonus

- Earn $150 points on Dining

- Welcome Bonus

Click here to read; Do I Really Need a Travel Insurance?

2. Capital One Venture Rewards

Another best travel credit cards is to earn miles on every purchase. When you use this credit card visitors feel more flexibility to save many travel expenses. Capital one Venture Rewards is renowned for its good number of rewards and travel perks.

This credit card does not include any foreign transaction fees and expert users which may expand and save from transfer to 18 airlines and hotels. Famous features of this credit card are;

- Easy to redeem miles in purchases for traveling

- Convert to cash from other travel credit cards

- Decent annual fees

- No foreign transaction fees

- Good airline and hotels transfer partner

- Availability of perks

- Redeem miles for travel

3. American Express Platinum

This American Express platinum premium credit card offers a wide range of travel-friendly benefits. One thing we should remember here is that this card is not easy to get. If you want to get this card, your income should be high and your credit score should be more than 700+. If you have a very decent credit score, then the probability of getting credit is slightly high.

Keeping an American Express Platinum credit card is considered as a prestigious person in the society. Designed and popular for big spenders and continuous travelers. Famous features of this credit card are;

- Airport lounge access,

- Airline fee credits,

- Hotel status upgrades, and

- Concierge service.

- It also provides generous rewards on travel purchases.

- Elite tier membership

- Save our credit card details

- Hertz gold plus reward

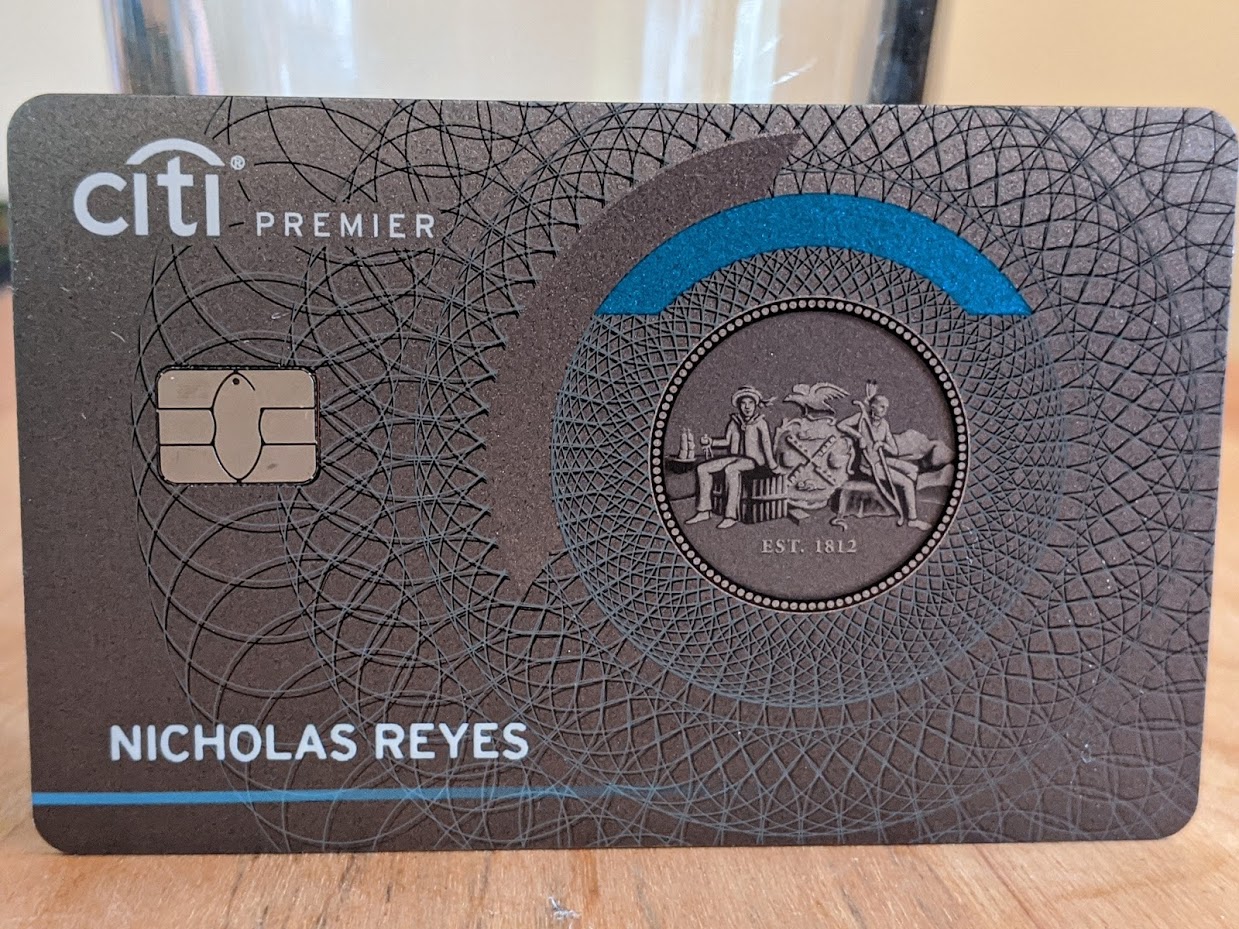

4. Citi Premier

In Citi Premier travel credit card, you will earn a special point called “Thank You” points on various travel-related sections and facilities. This credit will not charge any foreign transaction fees and provide protection to enhanced travel benefits.

Citi Premier credit cards are easy to get compared to most travel credit cards. $75,000 is the minimum income requirement to get this credit card. A plastic card shines its numerous features, lets see one by one

- Mid-level annual fees

- No foreign transaction fees

- Welcome bonus

- World elite Mastercard benefits

- Purchase protection

- Extended warranty

- $100 discount on hotels bills

World’s Most and Least Powerful Passports

5. Discover it Miles

:max_bytes(150000):strip_icc()/discover_it_miles_FINAL-086ce4eef1fd4a89997fd54ee50d0d08.png)

Discover it Miles offers unlimited 1.5x miles per 1 dollar spent, without any extra annual charges. which help us to increase our first-year earnings; therefore it is a great option for occasional travelers and money savers.

The minimum credit limit of this card is around $500. But sometimes it will expand depending on traveler’s creditworthiness. Discovering miles gives the option to spread the cost of your flight over time. Same like Citi credit card, Discover it Miles also offers tremendous amount of travel benefits to their customers. Some of the famous features of this credit card are;

- No over-limit fees.

- 100% U.S based customer services

- Here you will get an option to select the card’s color.

- No pay-by-phone fee

- Free alert in case of any your number found on a dark website.

- Free notification.

- Free credit scorecards.

Click here to read; Health Benefits of Traveling and Why you should Travel Abroad?

6. Bank of America Travel Rewards

This Travel credit card provides a simple rewards format without any yearly charges. Here you will get plenty of points on the purchase. Bank of America Travel Rewards primarily more helpful where visitors try to credit points on redeemed or saved future for travel expenses.

A flexible reward is a unique feature of this credit card having a close tie-up with different airline and hotel chains. Best travel credit cards without any foreign transaction fees are also included in this travel credit card. Famous features of this credit card are;

- Welcome bonus

- Travel insurance coverage benefits

- Get 3 points per dollar spent on the car, hotel booking, and airline booking.

- No annual charges.

- Only 4% of Balance transfer fees.

- No fees for foreign transaction purchases.

- Lost luggage reimbursement.

- Trip delay and cancellation coverages.

- No liability protections.

7. Capital One Savour Rewards

Capital One Savour rewards listed one of the best travel credit cards, made specially to enjoy dining and entertainment while traveling. This card has the ability to earn lucrative rewards in those categories without any foreign transaction fees.

More travel friendly credit card gives 4% cashback on dining and entertainment, 3% on groceries, and 1% on other purchases. Travelers are also eligible to get an 8% cash back on select capital one entertainment purposes. Famous features of this credit card are;

- Higher cash back

- Good redemption offers

- Uber benefits

- Travel accident insurance

- 24/7 travel assistance

- Credit monitoring

- Alert on accounts

- Protection from fraud

8. Southwest Rapid Rewards Plus

If you are a domestic traveler, then this Southwest Rapid Rewards Plus card offers generous rewards, especially on Southwest Airlines purchases, and other travel benefits like free checked bags and anniversary bonus points.

This card holder is eligible to enjoy merchandise, gift card, hotel stays, rental cars, cardmembers experience, and flights on global carriers. A best travel credit cards provides a good rapid reward at 1.4 each. Famous features of this credit card are;

- Anniversary bonus point

- Access to Chase offer

- Baggage delay insurance

- Lost luggage reimbursement

- Purchase protection

- Extended warranty protection

- Save on inflight purchase

- Card Referral bonus

9. Marriott Bonvoy Boundless

With the help of this card, you earn hotel points that you can redeem at Marriott properties across the world. It offers a solid rewards program, complimentary elite status, and other travel benefits.

Every year Marriott Bonvoy Boundless credit card provides a free certificate to their cardholder valued at 35,000 points. Free night awards will also be added to your account. Famous features of this credit card includes;

- Provide insurance to trip delay and baggage loss

- No extra fee for foreign transaction fees.

- Visa attendant

- Anniversary free night

- Travel and purchase coverage

- Ability to earn elite status

- Partner benefit

- Pay over time

10. United Explorer Card

Last but not the least, United Explorer Card majorly designed for United Airlines repeated flyers. United purchases, priority boarding, free checked bags, and other travel perks are included in the offers of miles.

Major benefits from this card are, you will get 25% as a statement credit, when you purchase food, beverages, Wi-Fi onboard, and premium drink purchased from United Club locations. Famous features of this credit card are;

- Bonus miles

- 25% cashback on inflight purchase

- Collections of luxury hotels and collections

- Visa concierge

- Mileage plus program

- Attractive reward points

- Up to $100 global entry free credit

- Free first checked bags

Final thoughts

Above all Best Travel Credit cards play a more serviceable role in every traveler’s journey. When it comes to travel your personal travel preferences, spending patterns, and the specific benefits offered by each card are a matter. As a traveler, it is important to read the terms and conditions and compare the rewards, fees, and benefits which are most preferred for your trip plans.

Related Articles: 11 Travel Scams to Avoid by the Travelers.

Q : What is the best travel credit card?

A : 1. Chase Sapphire Preferred

2. Capital One Venture Rewards

3. American Express Platinum

4. Citi Premier

5. Discover it Miles

6. Bank of America Travel Rewards

7. Capital One Savour Rewards

8. Southwest Rapid Rewards Plus

9. Marriott Bonvoy Boundless

10. United Explorer Card